Medicare Insurance

Medicare Survey

Click here to connect to Connecture/RetireFlo Fill out our survey to find which plans are available in your area!

Slide Presentation

Medicare Slide Show

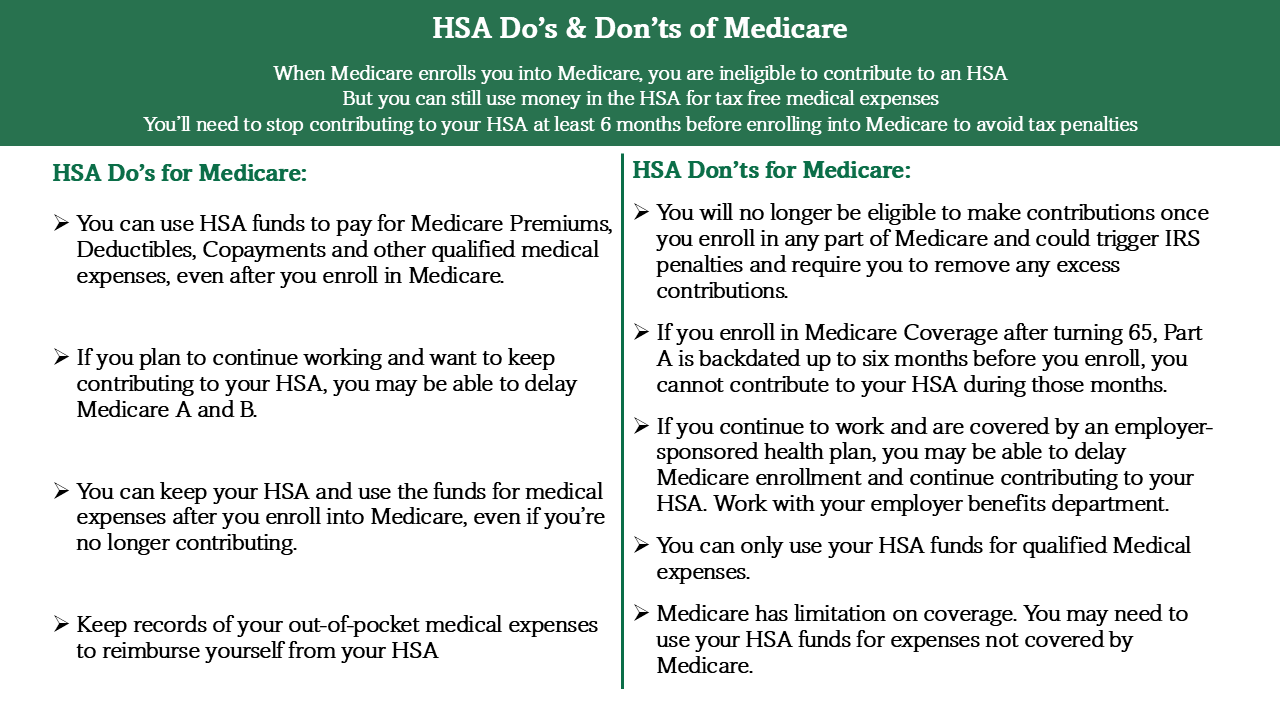

HSA Do's & Don'ts for Medicare

Do’s & Don’ts

Plans Available

Plans that are available for Medicare

Indemnity Plans

Can protect you from financial losses from high deductibles & out of pockets

Dental

This may be an option you would like to include while on Medicare

Vision

This may be an option you would like to include while on Medicare

Advantage vs Supplemental

Take a look at a few differences between Medicare Advantage and Medicare Supplemental Plans

Medicare Information Links

The following are some links to Medicare information

Medicare Self Enroll

Click here to be re-routed to sign up for Medicare

International Medical Travel Insurance

It provides coverage for unexpected medical expenses while you’re traveling outside your home country.

Typically includes emergency medical treatment, hospital stays, evacuation, and sometimes trip interruption due to medical reasons.

This type of insurance helps protect you from high out-of-pocket healthcare costs while abroad.

Plan Options

Medicare Cost Plans are a type of Medicare health plan available in certain areas that combine features of both Medicare Advantage and Original Medicare. You can receive services through the plan’s network, but if you go out-of-network, Original Medicare may cover the costs. These plans offer flexibility and are a good option for those who want more provider choices while still enjoying plan benefits like prescription drug coverage.

Medicare Advantage Plans (also known as Part C) are an alternative to Original Medicare, offered by private insurance companies approved by Medicare. These plans bundle Medicare Part A (hospital) and Part B (medical), and often include Part D (prescription drug coverage) along with extra benefits like dental, vision, or hearing. Many offer lower out-of-pocket costs but require using a network of providers.

Medigap Plans (also known as Medicare Supplement Insurance) are policies sold by private insurers to help cover the “gaps” in Original Medicare, such as copayments, coinsurance, and deductibles. These plans give you predictable out-of-pocket costs and flexibility to see any doctor who accepts Medicare. Medigap does not include prescription drug coverage, so it’s often paired with a separate Part D plan.

Medicare Part D is prescription drug coverage offered through private insurance companies approved by Medicare. It helps cover the cost of prescription medications, including both generic and brand-name drugs. You can get Part D as a standalone plan with Original Medicare or as part of a Medicare Advantage plan that includes drug coverage.

Hospital Indemnity Plans provide a cash benefit if you’re hospitalized due to illness or injury. The benefit is paid directly to you, not the hospital, and can be used for any expenses—medical or non-medical—such as deductibles, transportation, or household bills. These plans help offset out-of-pocket costs not covered by your primary insurance. They cover frequent hospital visits, overnight stays and out patient surgery.

Cancer Indemnity Plans provide a lump-sum payment or ongoing benefits if you’re diagnosed with cancer. This money is paid directly to you and can be used for anything—from medical bills and travel expenses to everyday living costs—helping ease the financial burden during treatment and recovery. It’s designed to supplement, not replace, your primary health coverage.

Critical Illness Indemnity Plans pay a lump-sum benefit if you’re diagnosed with a serious illness such as a heart attack, stroke, or cancer. The payout goes directly to you and can be used however you choose—whether for medical bills, travel for treatment, or everyday expenses. This coverage helps provide financial relief during a health crisis when unexpected costs arise.

Accident Indemnity Plans provide a cash benefit if you suffer an accidental injury. The benefit is paid directly to you and can help cover out-of-pocket expenses like emergency room visits, hospital stays, X-rays, or even everyday bills while you recover. It’s a helpful supplement to your primary health insurance, especially for those with active lifestyles or high-deductible plans. It helps if your injured or pass away due to an accident.

Life Insurance Plans

Final Medical & Burial Expenses

Travel Insurance provides coverage for unexpected events while you’re traveling, such as trip cancellations, medical emergencies, lost luggage, or travel delays. It helps protect your financial investment and gives you peace of mind whether you’re traveling domestically or internationally. Plans can be customized based on your trip length, destination, and coverage needs. Click here if you would like to check out what we offer for travel insurance for any upcoming trip!

Dental Plans help cover the cost of routine dental care such as cleanings, exams, X-rays, fillings, and other dental procedures. Plans may include preventive, basic, and major services, depending on the coverage level. They are available as standalone policies or can be included with other health or Medicare Advantage plans.

Vision Coverage for Medicare is limited under Original Medicare, which generally does not cover routine eye exams, glasses, or contact lenses. However, some Medicare Advantage Plans may include vision benefits such as annual eye exams, eyewear allowances, and discounts on corrective lenses. For those needing regular vision care, a Medicare Advantage plan or standalone vision policy can help fill the gap.

There are four parts to Medicare, click here “Medicare Parts” to learn more.

To find out when you should be signing up for Medicare click here “When to Sign Up for Medicare”

Testimonials

My husband and I have worked with Jamie Aune for several years. She researches plans ahead of our visit with her and is very thorough. We have switched our drug plan many times over the years depending on which plan is the best for each one of us. When we had a question about a procedure or a question about a bill she got back to us right away and helped us figure it out. I would highly recommend her to my family and friends and I have. We appreciate Jamie so much!

Linda J

Jamie is very knowledgeable and was able to guide us though medicare enrollment as my wife and I just became of age. We had a million questions for her and she was able to answer them

Robert P

We do not offer every plan available in your area.

Any information we provide is limited to those plans we do offer in your area.

Currently we represent 9 organizations which offer 89 products in your area. Please contact Medicare.gov or 1-800-MEDICARE or your local State Health Insurance Program for help with plan choices.

I am authorized to offer Medicare plans in WI, MN, SD, ND, IA, AZ, FL